In Texas’ rapidly evolving economic landscape, the Jobs, Energy, Technology, and Innovation Act (JETI) marks a significant stride toward fostering sustainable economic growth and technological advancement. Officially launched in early 2024, JETI is designed to attract substantial business investments to Texas with property tax incentives.

The program's focus on innovation and technology aligns with global economic trends, potentially positioning Texas as an attractive destination for international businesses looking for a business-friendly environment.

Though the program offers potentially meaningful tax relief, there are important stipulations around timing, performance, compliance, and disclosure that all applicants should be aware of before pursuing these incentives.

Learn more about potential benefits and eligibility criteria of this program, which recently opened to applications, and explore considerations important to applicants to determine whether the JETI program’s objectives and requirements align with your company’s ethos and growth strategy.

Overview of the JETI Program

The JETI program represents a strategic initiative by Texas to bolster economic growth through targeted incentives aimed at attracting large-scale business investments. JETI is designed to fill the gap left by the expired Chapter 313 program, but with a renewed focus on transparency, accountability, and broader economic benefits.

The termination of the Chapter 313 tax incentive program at the end of 2022 left a noticeable void in Texas' economic development strategies. Chapter 313 played an important role in drawing major investments to the state by offering significant property tax abatements. However, the program faced increasing scrutiny and criticism over its impact on public school finance and perceived inequities in tax burden distribution.

Critics argued that while it spurred job creation and investment, it also resulted in lost revenues for public services, notably affecting educational funding structures across the state.

Objectives of JETI

The primary objectives reflect the state's commitment to fostering a robust and diversified economy:

- Attracting investment. Encourage both domestic and international companies to invest in Texas, thereby expanding the state's industrial and technological base.

- Job creation. Generate high-quality, high-wage jobs across various sectors, directly benefiting the state’s workforce.

- Economic diversification. Support growth in emerging industries, including technology and sustainable energy solutions.

- Community development. Promote development in underserved regions, particularly through incentives for projects in designated Qualified Opportunity Zones (QOZ).

Potential Benefits of the JETI Program

The JETI program is designed to contribute to the success of both businesses and local economies.

Benefiting Businesses

The JETI program offers substantial property tax incentives. Qualifying businesses can benefit from property tax reductions in the form of an appraised value limitation for school district maintenance and operations (M&O) taxes, which is typically the largest assessment on a Texas property tax bill.

Successful applicants are eligible for a 10-year, 50% limitation of the taxable value of qualifying property. Projects located in a federally designated QOZ qualify for a 25% appraised value limitation, reducing its M&O tax liability by 75%.

Additionally, 100% reduction of taxable value applies to construction in progress, eliminating pre-operational property taxes. These tax savings meaningfully lower the operational costs for businesses and enhance the return on investment for new projects.

Benefiting Local Economies

The program is designed to stimulate local economies through job creation and infrastructure development.

Job Creation

By stipulating job creation quotas and wage minimums, JETI supports investments translating into direct employment opportunities. These jobs are typically high-wage and often come with benefits, raising the standard of living for Texas residents and attracting a skilled workforce to the state.

Economic Multiplier Effect

The attraction of new businesses and the expansion of existing ones fosters a multiplier effect throughout the local economy. As companies set up operations, there’s increased demand for local suppliers, services, and contractors, further spurring economic activity and job creation in ancillary industries.

Eligibility Requirements for the JETI Program

JETI sets specific eligibility criteria designed to promote high-wage jobs in targeted industries pivotal to the state's strategic economic growth. These requirements support aligning program benefits with Texas's long-term economic development goals.

NAICS Driven

The program specifically targets industries under certain North American Industry Classification System (NAICS) codes.

Eligibility is focused on sectors that are expected to drive substantial economic growth and technological innovation in the state, such as:

- Manufacturing, NAICS 31-33, including production of high-tech equipment or technology

- Utility services, NAICS 2211, projects that provide dispatchable energy generation, crucial for supporting the state's energy needs

- Natural resource development, NAICS 11 and 21, particularly projects that involve agriculture, forestry, fishing, hunting, mining, quarrying, and oil and gas extraction

- R&D, NAICS 5417, facilities that focus on the innovation of technology and scientific advancements

- Critical infrastructure such as water and sewage utilities, NAICS 2213; Petroleum bulk stations and terminals, NAICS 424710; and pipeline transportation, NAICS 486

The program’s emphasis on these sectors underlines Texas’ strategic goals to enhance its industrial capabilities and innovation potential and make it an attractive destination for significant capital projects.

Through JETI, Texas not only aims to attract and retain top-tier companies but also hopes that these entities contribute positively to the state's economic landscape and the welfare of its communities.

It is important to note that renewable energy projects or energy storage facilities are not eligible.

Minimum Commitments

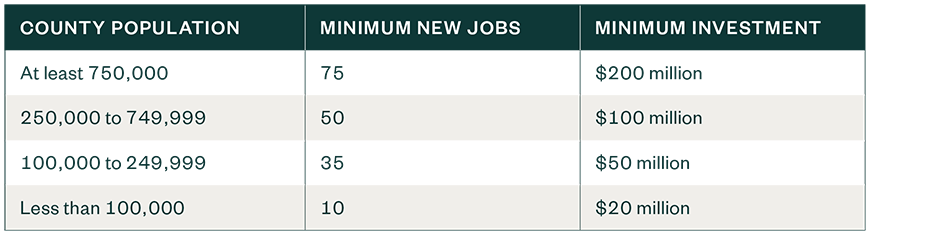

To be eligible for JETI benefits, applicants must meet minimum capital investment and job creation requirements, which vary based on the population of the county where the project is located.

New jobs must meet certain requirements including:

- Wages exceed 110% of the county’s annual average for the applicable industry sector

- At least 1,600 hours of work annually in connection with an eligible project

- Applicants offer and contribute to a group health benefit plan for each associated employee

Projects that span multiple counties will be subject to the commitments of the county with the smallest population. For those seeking the larger appraised value limitation available to QOZs, note that the entire project including its boundaries must fall within a QOZ.

Hypothetical Example

Let's consider a very simplified example of a hypothetical company specializing in developing advanced computer technologies.

Project Description

After an extensive site selection process, the company chose a site near Austin, Texas, in Travis County and Del Valle Independent School District (DVISD) for its stable business environment and the incentives offered by JETI. The company plans to establish a new $300 million research facility with 200 high-wage jobs. Assume DVISD’s M&O tax rate is 0.6728 cents per $100.

Eligibility and Benefits

With a county population over 750,000, the project meets the minimum new jobs and capital investment required is 75 and $200 million, respectively. The facility would fall under the R&D category, making it eligible for JETI incentives. Located entirely in a QOZ, the project qualifies for a 25% appraised value limitation, which is a 75% reduction in taxable property value. The JETI program encouraged the company to locate the project in Texas.

Economic Impact

The facility is projected to create 200 high-wage jobs in the region, significantly impacting local employment rates. The average salary for these positions is expected to be 120% of the country’s average wage for the applicable industry sector, providing substantial income to the local community.

Potential Tax Savings

Assuming all other criteria are met, for M&O tax purposes over the next 10-year period, the company would be taxed at 25% of its taxable appraised value. If that value is $300 million at the time it becomes operational and is first subject to tax, then its M&O tax liability that first year is assessed on only $75 million. At the assumed M&O tax rate, the taxpayer receives over $1.5 million in tax savings in just the first year, which could be reinvested into operations like further expansion and enhancing employee benefits.

Important Considerations

Though the potential benefits are attractive, all potential applicants should be aware of the following factors.

Timing

A fully executed JETI incentive agreement must be in place before construction begins. The review process can take several months, so applicants should plan for a timeline from submission to approval that may take up to 180 days, depending on the complexity of the project and the completeness of the application submitted.

Performance Bond or Guarantee

Applicants must be aware that significant recapture, penalties, and interest may apply for failure to comply with program requirements.

When entering into a JETI agreement, applicants must either obtain a performance bond from a third-party surety company or have its parent company guarantee its performance. If the applicant chooses the performance bond option, this bond is set at 10% of the estimated gross tax benefit the project is expected to receive over the incentive period and must be active for the duration of term of the JETI agreement. In lieu of a performance bond, an applicant's parent company must guarantee the applicant’s performance or the parent company is required to pay an agreed-upon amount. Specific terms related to either the bond or guarantee, whichever is chosen, will be detailed in the JETI agreement.

Application Fee

A nonrefundable application fee of $30,000 is required to process the JETI application. This fee, payable to the local school district, helps cover the administrative costs of processing applications and indirectly supports local education funding.

Compliance

JETI mandates that approved companies submit detailed reports every two years.

These reports must include comprehensive data on:

- Job creation

- Salary levels

- Economic impact of projects

This requirement is designed to ensure that the incentives granted lead to tangible benefits for the Texas economy.

Public Disclosure

Though the JETI deems trade secrets and payroll records to be confidential business information, other details of all JETI agreements, including the names of recipient companies, the nature of the incentives, and the expected economic outputs, are made publicly available.

Further, decisions regarding the approval or rejection of applications are documented and published, providing insights into the criteria and reasoning behind each decision.

Public hearings and community involvement are also part of the decision-making process at the local school district level, which ensures community interests are considered in economic development initiatives.

This transparency is intended to keep the public informed about how state resources are being used to stimulate economic growth and to hold both the state and recipient companies accountable.

We’re Here to Help

For guidance on JETI eligibility and claiming program benefits, contact your Moss Adams professional.